USDA Direct Loans are one of the least understood homeownership programs in the country. They offer a path to owning a home for people who often have no other financing options — but they come with rules, limits, and long-term obligations you need to understand before you apply. If you’re just looking for a broad overview of loan types, you should start here and return to this article if you need a deep dive.

I worked for USDA Rural Development on the Single-Family Housing Direct program, reviewing applications from across Texas. What I learned is this: the program can be life-changing if you qualify and if you understand how it really works.

If you’re considering USDA Direct, start with the agency’s official page:

USDA Single-Family Housing Direct Home Loans

I also strongly recommend reading my entire Home Buying Series — especially Step 2: Budgeting. USDA Direct uses different assumptions than traditional lenders, and some “don’t do this” situations in my budgeting tool may still qualify under USDA rules. That’s both the opportunity and the risk of this program.

Who USDA Direct Is Designed For

USDA Direct is only for buyers who meet all of the following criteria:

- Very-low income or low income (based on adjusted household income)

- Purchasing in a rural eligible area (population under 20,000)

- Buying a home that meets the agency’s decent, safe, and sanitary standards

- Unable to obtain traditional financing

These requirements work together, and falling outside even one of them will usually make a borrower ineligible for USDA Direct. USDA Direct is, by regulation, a lender of last resort. Borrowers must be unable to obtain credit from other lenders on reasonable terms. If a bank or mortgage lender can approve you for a loan, USDA Direct cannot. That’s how all USDA lending programs are structured — from individual borrowers to municipal projects.

Also, notice the phrase “household income,” not borrower income. That distinction matters.

Income Limits: Household vs Borrower Income

One of the biggest surprises for applicants is that USDA Direct looks at household income, not just the income of the people on the loan. That means every dollar earned by everyone who will live in the home is counted when determining eligibility.

This includes:

-

Adult children living at home

-

Parents or grandparents with Social Security income

-

Family members with part-time or seasonal jobs

-

Anyone who contributes income and will reside in the property

Even if someone isn’t on the loan, their income still affects your USDA Direct eligibility.

On the other hand, I’ve also seen multi-generational households qualify together because their combined income stayed within the limits. But that can be risky. If you are depending on a household member’s income to make the mortgage payment and that person dies, moves away, or has a change in employment, you may find yourself unable to maintain the loan.

USDA uses adjusted household income, meaning certain deductions are allowed (dependents, childcare expenses, medical expenses for elderly households, etc.). But the starting point is still the total income of everyone in the household.

Below are the Fiscal Year 2025 (ended September 30, 2025) income limits for the Abilene, Texas MSA (Taylor County).

These limits apply only to USDA Direct and Guaranteed loans. Other programs (FHA, VA, Conventional) do not use household income limits.

A key takeaway: If someone else in your home earns income, it may either push you over the limit — or help you qualify, depending on the program.

FY 2025 Adjusted Income Limits — Abilene, TX MSA (Example)

| Program | 1–4 Person Household | 5–8 Person Household |

|---|---|---|

| Very Low Income | $43,650 | $57,650 |

| Low Income | $69,850 | $92,250 |

| Moderate Income (Guaranteed Program) | $119,850 | $158,250 |

| 38-Year Term Eligibility | $52,400 | $69,200 |

These limits vary by location — check USDA’s website for your county.

Geographic Eligibility: “Abilene Address” Doesn’t Mean Eligible

USDA Direct (and USDA Guaranteed) loans can only be used in rural-eligible areas, which generally means communities with a population under 20,000. For many buyers, that definition creates confusion — especially in places like Abilene.

Here’s the part most people don’t realize:

Homes inside the Abilene city limits are not eligible for USDA Direct or Guaranteed loans.

But some homes with an Abilene mailing address are eligible because they sit outside the incorporated city limits in rural or semi-rural areas.

This is why you must check every individual address you’re considering. A ZIP code alone won’t tell you anything — and neither will the mailing city name.

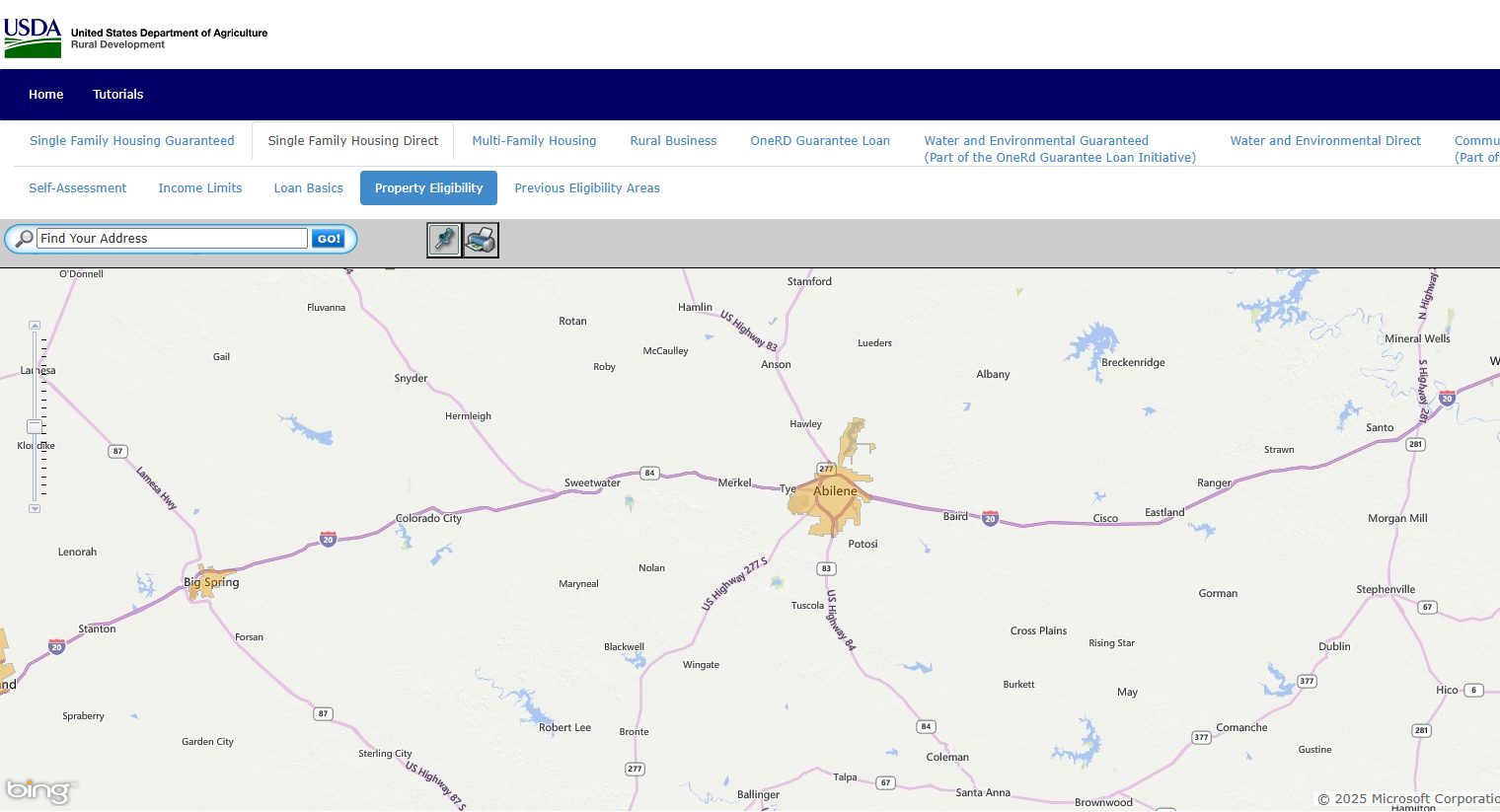

The USDA property eligibility map is not intuitive. You have to select the “Property Eligibility” tab before the map even appears. (See image below with the arrow pointing to the tab.)

Once on the map, you can:

-

Enter a specific address

-

Zoom in on areas

-

Compare the ineligible zones (highlighted in orange) to the surrounding eligible regions

Eligible areas don’t guarantee that a specific property will qualify. The home itself must also meet USDA’s standards for decent, safe, and sanitary housing.

For example, I once saw a deal fail even though the address was fully eligible — because the home sat on a private road that did not have an all-weather surface. USDA could not lend on it. Issues like that are more common than most buyers realize.

If you’re searching in or around Abilene, or any metro area that is ineligible, assume nothing. Always check the map, and always check the exact address.

Click the “Property Eligibility” tab to open USDA’s eligibility map — you must check every address to confirm whether a property qualifies for USDA Direct or Guaranteed loans.

The USDA eligibility map highlights ineligible areas in orange—zoom in or search a specific address to verify whether a home may qualify. An Abilene address isn’t always located inside Abilene’s ineligible city limits.

Why USDA Direct Is Harder Than It Looks

The application process itself isn’t especially complicated. What makes USDA Direct difficult is the market reality, not the paperwork.

I reviewed countless applications where the buyer technically qualified — but the amount they qualified for would not buy a house in “decent, safe, and sanitary” condition. Affordable rural housing stock has shrunk dramatically, especially since the 2020 market shift. Areas around Abilene, TX — my hometown — that used to be cheap are becoming nearly as expensive as Abilene, especially with the bump in prices during COVID and the housing shortage caused by the temporary influx of workers building the new AI facility.

In other words: eligibility is one thing; finding a house you can actually buy is another.

USDA Direct can work beautifully. But the search is usually tough, and the timelines slow.

Loan Terms: 33 or 38 Years

USDA Direct loans work differently from traditional mortgages when it comes to loan terms. The standard term is:

-

33 years for most borrowers

-

30 years for manufactured homes

-

38 years for very-low-income borrowers who need a longer term to achieve an affordable payment

Longer terms lower the monthly payment, which is the point — the program is designed to make homeownership possible for households that cannot qualify anywhere else. But there’s a tradeoff: the longer the term, the more interest you pay over the life of the loan.

A 38-year mortgage may make a home affordable today, but buyers must understand that it also increases the long-term cost of the loan significantly.

USDA determines eligibility for the 38-year term strictly by income. Only very-low-income borrowers may use it, and only when the 33-year term would make the payment unaffordable under USDA’s formula.

Bottom line: USDA’s longer terms are tools to reduce your monthly payment — not to reduce what you owe overall.

How Payment Subsidies Really Work

The biggest misunderstanding I saw in the USDA Direct program is the meaning of the word “subsidy.” Many applicants assumed it worked like Section 8 — a monthly reduction in payment that never has to be repaid.

That is not how USDA Direct works.

Here’s what actually happens:

-

USDA may reduce your effective interest rate — sometimes down to as low as 1%.

-

The difference between your subsidized rate and the market rate becomes a deferred loan.

-

That deferred amount accumulates over time.

-

You repay it when you sell, refinance, or pay off the mortgage.

Subsidy Recapture Isn’t Optional

This means a borrower could make payments for decades and still owe tens of thousands of dollars in subsidy recapture at payoff — not because anything went wrong, but because that is simply how the program is structured.

USDA-Rural Development will sometimes offer a reduced payoff amount if the subsidy is paid in a lump sum, such as during refinancing. But borrowers should never assume subsidy is “free money.” It is not grant assistance. It is a loan.

The subsidy isn’t reducing what you owe — it’s reducing what you pay each month.

Those are not the same thing.

This is why borrowers must understand the long-term obligation before entering the program. USDA Direct can make a home affordable today, but the repayment obligation follows you until the last dollar is satisfied.

The one upside is that the subsidy doesn’t earn interest. It’s simply the difference between the lower, subsidized rate you paid each month and the full interest you would have paid at the note rate. That amount becomes a deferred, interest-free loan that you repay when you sell, refinance, or pay off the home. In this sense, it truly is a subsidy — you benefit from reduced payments without the subsidy itself accruing additional interest.

The Part No One Tells You: You Cannot Walk Away

A USDA Direct debt does not disappear unless it is paid in full. If a borrower defaults and the loan is accelerated, USDA will pursue collection through the Treasury Offset Program. That means:

-

Your future federal tax refunds can be intercepted.

-

Your Social Security benefits can be garnished.

-

The debt remains owed to the federal government indefinitely.

Unlike private lenders, the federal government does not face statutes of limitation in the same way, which means the debt remains collectible for life. If the borrower dies still owing a balance, USDA may collect from the borrower’s estate.

So yes — in practical terms, a USDA Direct debt follows you until it is repaid or until you die.

In practice, USDA will sometimes forgive or reduce certain amounts when a borrower sells the property for less than the balance, or when a borrower successfully refinances out of the Direct program. But that is very different from walking away.

If you default and abandon the loan, USDA is unlikely to write anything off. The debt is turned over to the Treasury Department for collection, and it will remain collectible until it is paid. Treasury can intercept tax refunds, garnish Social Security, and pursue the balance for the rest of your life. Only then, or upon your death, does the obligation end—unless USDA voluntarily settles or compromises the debt, which is rare when the borrower simply walked away.

I’ve even seen situations where borrowers could have walked away from USDA Direct with money in their pocket — but didn’t realize it. In one case from my office, the homeowner was falling behind and believed foreclosure was inevitable. In reality, the property was worth more than the remaining loan balance plus the subsidy they owed. They were advised to sell, settle the debt, and keep the remaining equity.

Because the process felt overwhelming and they didn’t fully understand their options, they walked away instead. USDA ultimately foreclosed, and the government recovered the equity — equity that could have helped the borrower rebuild.

This isn’t about intelligence or effort. It’s about how confusing and intimidating these situations feel when you’re stressed and don’t have someone in your corner explaining the implications clearly. One of the biggest risks with USDA Direct is not the loan itself — it’s not having the information or confidence to make the right move when things get hard.

Closing Timelines Are Slow — Even When Funds Exist

USDA is not a bank with a vault.

Every dollar for a USDA Direct loan comes from the U.S. Treasury and depends on annual federal appropriations — not on deposits, reserves, or internal lending capital. Because of that, the program operates on a completely different timeline than traditional lenders.

That means:

-

Government shutdowns can delay closings.

-

Funding lapses can pause approvals.

-

Even in normal times, Direct loans often take 50–100% longer to close than Conventional or FHA/VA loans.

But even when funding is available, USDA Direct loans still move slowly for another reason:

The USDA must approve every step in-house.

Unlike banks, mortgage companies, or credit unions, USDA processes, verifies, and signs off on every part of the loan internally. Many field offices have extremely small staffs — sometimes just one or two people covering multiple counties. Every application, clarification, income verification, and final approval flows through the same tiny team.

The workload is enormous, and staffing levels rarely match the demand.

When you combine:

-

centralized in-house processing,

-

small regional staff, and

-

reliance on federal Treasury funding,

…it becomes clear why USDA Direct timelines are significantly slower than USDA Guaranteed, FHA, VA, or conventional mortgages.

Most borrowers should expect 6–8 week closings — sometimes longer.

Some sellers hesitate to accept USDA Direct offers because of these timelines, so buyers should be prepared to set expectations early and have their documentation ready well in advance.

How USDA Direct Differs from USDA Guaranteed, FHA, VA, and Conventional Loans

Here’s the simplest breakdown:

- Conventional: Fastest closings, flexible conditions, but higher credit/income requirements.

- FHA: Low down payment, more property repairs required.

- VA: No down payment, great for veterans, strict appraisal standards.

- USDA Guaranteed: No down payment, faster than Direct, processed by traditional lenders.

- USDA Direct: For very-low and low-income buyers, slowest closing, strict requirements, and subsidy repayment.

Conventional → Faster.

FHA/VA/USDA Guaranteed → Middle tier.

USDA Direct → Slowest.

If You’re Considering USDA Direct Loans, Start With Your Budget

USDA Direct takes significant steps to make sure a borrower’s payment is workable. The agency reviews income, expenses, dependents, household members, and long-term affordability far more carefully than most traditional lenders. On paper, USDA wants the payment to fit — and they do everything they can to structure it responsibly.

But here is the truth borrowers that don’t always hear:

USDA Direct loans often sit right on the edge of what a household can sustain.

That isn’t because the program is poorly designed. It’s because Direct exists precisely for people who cannot qualify anywhere else. A bank, credit union, or mortgage company would simply decline these applicants — not because they don’t deserve a home, but because the financial margin is too thin for traditional underwriting models.

USDA steps in because no one else will.

But that means the borrower must be even more careful.

Why You Should Still Use My Budget Tool

USDA’s affordability test assumes:

-

Your income will increase over time

-

Your expenses will remain mostly stable

-

Your household composition won’t unexpectedly shift

-

Your home will not require major repairs early on

All of those might hold true… or they might not.

But USDA structures Direct loans with the expectation that a borrower’s financial situation will improve over time, eventually allowing them to graduate into conventional financing–whether with USDA-Guaranteed or another product.

My Step 2 “Budget That Tells the Truth” tool gives you a real-world version of affordability — one that assumes:

-

cars break down,

-

electricity bills spike,

-

kids need things at school,

-

roofs leak,

-

hours get cut,

-

and life does not follow neat government worksheets.

USDA’s affordability calculation is designed to determine whether you fit the program — not whether the payment fits your life. That’s why Step 2 of my Home Buying Series is so important. Even if USDA approves you, your own budget must leave room for repairs, emergencies, and rising costs — because USDA cannot prevent the unexpected.

Your goal is not simply to buy. Your goal is to stay housed — something USDA Direct loans are designed to support, but only when the borrower understands the limits

USDA Wants You to Succeed — But You MUST Reach Out

This part is critical:

USDA Direct borrowers must contact USDA at the first sign of financial trouble.

The agency has multiple tools — payment assistance adjustments, moratoriums, re-amortizations — but they can only help if you communicate early.

USDA can help you if you reach out early — but they cannot help you if your file goes silent.

Officially, servicing requests are handled through the national servicing center in St. Louis.

In reality — and this is where experience matters — many smaller field offices do their best to guide borrowers through the process or point them toward the right forms and steps, because those offices know the borrowers personally and want them to succeed.

But in larger offices with heavy caseloads, that hands-on help is much harder. Borrowers must be proactive.

If you disappear, the system assumes you are choosing not to pay — not that you don’t know what to do.

Bottom Line

USDA Direct is a remarkable program for the households it serves, but it also requires:

-

caution,

-

honest budgeting,

-

clear understanding of risk, and

-

early communication if hardship arises.

Use USDA’s affordability test — but also use your budget to decide whether the payment fits your life, not just your paperwork.

Final Thoughts

USDA Direct can be an incredible program for the right family in the right situation. It can also be overwhelming, confusing, and risky if entered blindly.

USDA expects most Direct loan recipients to graduate — get better paying jobs, be more financially secure — so that they get moved into more traditional products… The program was never envisioned as one where you got a loan and stayed in it until it was paid off. The reality of rural economics means that a lot of people do stay in the program until payoff.

If you’d like help navigating your options, budget, or eligibility — or you simply want someone who understands the program from the inside — I’m always happy to talk.

About Me — Doug Berry, MBA, REALTOR®

The Bow Tie Agent

I’m a REALTOR® with Better Homes & Gardens Senter, Realtors who focuses on helping buyers understand the real-world side of homeownership — from lending and budgeting to navigating underwriting without surprises. With an MBA and experience as a lender with USDA Rural Development’s mortgage programs, I approach the process the same way I do with clients: clearly, calmly, and without sales pressure.

If you have questions about this step, need help preparing for a home purchase, or have a topic you’d like me to cover in a future article, feel free to reach out:

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link