Home Buying Budget – Step 2 of Doug Berry’s Buying Series

A real home buying budget is the foundation of every successful purchase.

Home Buying Series by Doug Berry, MBA — Realtor®

Step 2 of the Home Buying Series is all about building a real home buying budget—one that matches the way lenders think and the way you actually live.

Budgeting isn’t glamorous. But knowing where your money comes from and where it goes is one of the most important parts of the home-buying process. If you’re blowing 20% of your income on things you could live without, that’s money that could be going toward a house payment. And if a car note is eating most of your monthly margin, you’re eventually forced into a choice: a nicer vehicle or a home — because in a lot of cases, you can’t comfortably have both.

Building a home buying budget early helps prevent surprises once you begin talking to lenders.

This step isn’t about judgment. It’s about clarity.

And clarity is what lenders base decisions on.

If you missed Step 1 — checking and understanding your credit — you can read it here.

Start With the Basics: Track Where Your Money Actually Goes

There’s no single “right” way to build a budget. You can:

-

gather your bills and paystubs and write everything down,

-

input it into a spreadsheet (like the worksheet that accompanies this step), or

-

use budgeting apps that surface forgotten or duplicate charges.

Case in point: part of my phone bill was still charging me for a Wi-Fi hotspot in my wife’s car… which had been totaled. Without digging into the details, I would’ve kept paying it every month.

A quick warning

After a free trial ends, step back and ask whether the budgeting app is actually providing lasting value.

Canceling $20/month in subscriptions just to replace them with a $20/month budgeting app you stop using doesn’t help.

What You’re Actually Building: A Clear Home Buying Budget and Your DTI

What all this tracking ultimately does is help you understand your DTI — debt-to-income ratio.

That’s exactly what the worksheet calculates for you.

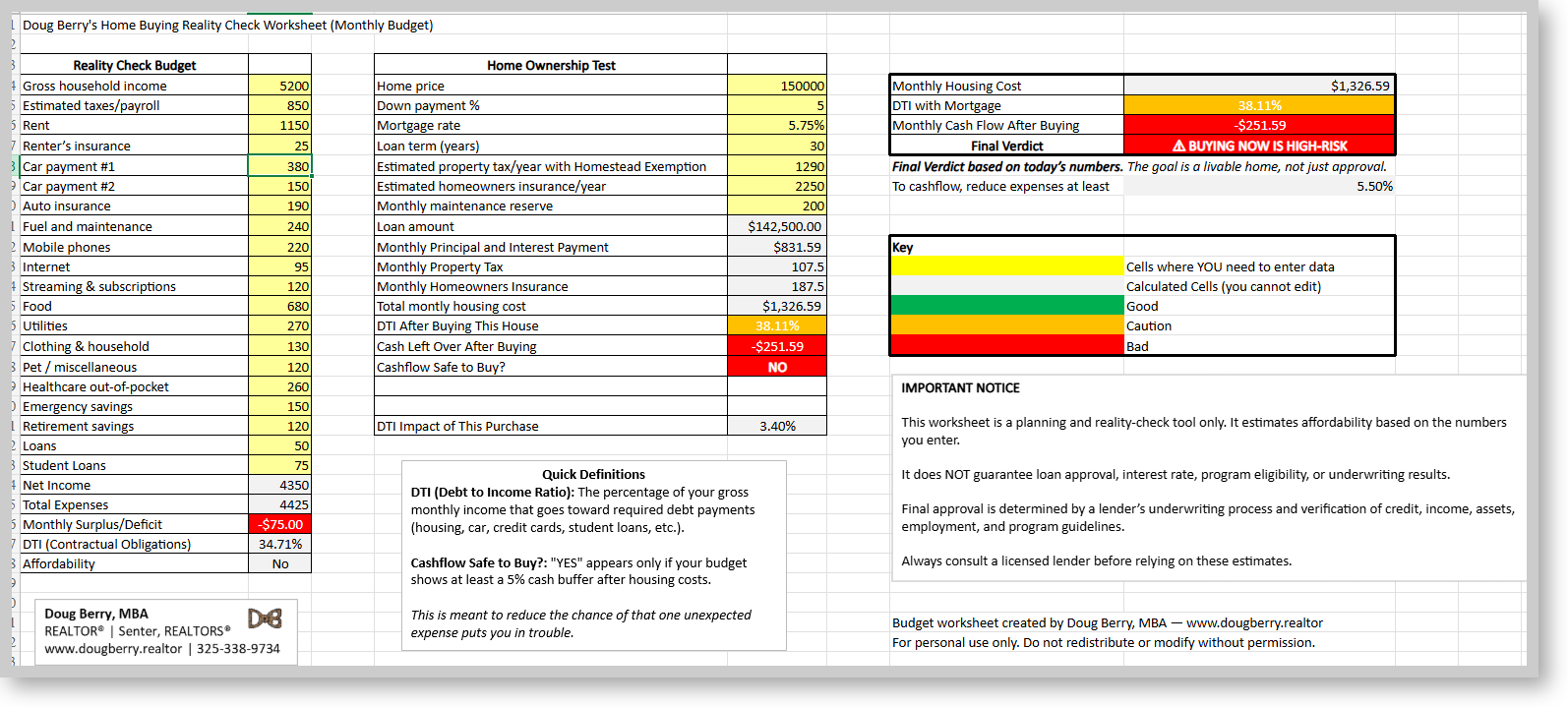

A real-world budget and DTI calculator—enter your numbers in the yellow cells to see whether a home fits your actual finances.

Download the Home Buying Reality-Check Worksheet

Use this fill-in-the-blank Excel worksheet to calculate your

real debt-to-income ratio and see whether a mortgage payment fits your actual budget.

Download Budget Worksheet (Excel)

Tip: The file opens in read-only mode. Click Download to save your own copy,

then enter your numbers in the yellow cells only — the worksheet does the rest.

DTI isn’t an opinion; it’s a lender’s mathematical snapshot of:

-

how much you earn, and

-

how much of that income is already locked into contractual payments.

And here’s the key distinction most buyers don’t realize:

What lenders count as debt

-

Rent

-

Credit card minimums

-

Personal loans

-

Student loans

-

Car payments

What lenders do not count as debt

-

Groceries

- Childcare

-

Utility bills

-

Gas

-

Phone bills

- Streaming Services

This is why your real-life budget and a lender’s budget often look nothing alike.

Your lender might say, “Yes, this works on paper,” while your bank account is saying, “Absolutely not.”

Note on Student Loans: For budgeting purposes, include your student loan payment as either your current required payment or 0.5% of your outstanding balance—whichever is higher. Many lenders must use a calculated payment for underwriting purposes even when your current payment is $0, and student loans that aren’t in repayment still count in your Debt-to-Income Ratio. Step 3 will go into how lenders apply this in more detail.

Where Lenders Get Nervous (and Where I Do)

Most lenders are comfortable when your back-end DTI (all debts + future house payment + taxes + insurance) stays in the high 30% range. Once you cross into the 40s, the bank starts getting nervous—and understandably so.

From experience, including my years at USDA:

-

38% is the point where borrowers can usually live their lives and afford the house.

-

41% was USDA’s maximum, and even then I was cautious—because the margin for error is very thin.

When your DTI gets too high, every unexpected bill hits harder and faster than people expect.

The Real Question You Must Answer Before a Lender Ever Sees Your Paperwork

Can I actually afford a home — comfortably?

A bank cares if you can make the payment.

You have to care whether you can keep making it without sacrificing stability.

Every home-search website will show you a mortgage estimate.

What they almost never show you is the true cost of owning a house:

-

Property taxes

-

Homeowners insurance

-

Maintenance and repairs

-

Higher utilities compared to an apartment or duplex

-

HOA dues

Your mortgage payment might be lower than your rent, but the total monthly cost of ownership rarely is.

Rising costs matter

At USDA, one of the biggest pitfalls I saw was rising taxes and insurance premiums.

If your loan has escrow (almost all do), increases become escrow shortages—and that often means:

-

a lump-sum payment, or

-

a higher monthly mortgage payment.

Both hit hard when your budget is already stretched.

Savings: The Uncomfortable Topic That Keeps People in Their Homes

Texans understand the concept of a rainy-day fund.

Homeowners need one too.

Something will go wrong:

-

the AC fails,

-

the water heater dies,

-

a roof leaks,

-

someone loses a job or takes a pay cut.

The standard “3–6 months of expenses” rule is solid—but difficult for many people.

The point isn’t perfection; it’s momentum.

Even $20–$50 per paycheck adds up.

That small cushion is the difference between a bad month and financial disaster.

(Note: the worksheet reflects this by showing that one good month does not equal long-term stability.)

On the Other End: Too Much Equity and Not Enough Cash

This is something people don’t talk about enough:

You can absolutely put too much into the house.

-

Yes, rolling some closing costs into the loan is normal.

-

Yes, putting more down saves interest over time.

But draining every account to buy a home leaves you house-rich and cash-poor, and that is far more dangerous than a slightly higher payment.

We’ll talk more about tools like HELOCs and reverse mortgages later—they can help in the right circumstances, but they are powerful enough (and risky enough) to deserve their own step.

A Quick Note on How Your Money Is Parked

After seeing countless bank statements, I can say with confidence:

Most people earn far less interest than they should.

For example:

One couple I worked with kept nearly $20,000 in an account earning 0.25%.

They could have been earning 4.5%.

That’s:

-

$50 a year vs.

-

$900 a year.

They were leaving $850 on the table annually—money that could have funded savings, repairs, or emergencies.

Big banks often keep customers in low-yield accounts.

A smart budget includes making your money work for you, not just tracking where it goes.

The Tradeoffs: What You Choose Determines What You Can Buy

Whether people admit it or not, homeownership comes with tradeoffs:

-

A new home or a new car.

-

Eating out often or building savings.

-

Flexibility or long-term roots.

Homes can be incredible tools for stability and wealth-building.

But they’re not the right choice for every season of life.

This step helps you identify which season you’re in.

Why Step 2 Matters

A clear home buying budget gives you confidence and prevents most first-time buyer mistakes. If you:

-

understand your credit (Step 1),

-

know where your money is going, and

-

have a realistic picture of your DTI,

then you will walk into Step 3 — choosing a lender with confidence instead of anxiety.

This is the moment where you stop guessing and start steering.

And with the included worksheet, you can see your numbers laid out the same way a lender will–taking the time to build a realistic home buying budget now makes the next steps with your lender far easier and far less stressful.

Next: Step 3 — Choose a Lender Who Explains, Not Sells

Once you know what you can comfortably afford, the next move is finding a lender who will explain your options—not pressure you, confuse you, or hide the “why” behind the numbers.

About Me — Doug Berry, MBA, REALTOR®

The Bow Tie Agent

I’m a REALTOR® with Better Homes & Gardens Senter, Realtors who focuses on helping buyers understand the real-world side of homeownership — from lending and budgeting to navigating underwriting without surprises. With an MBA and experience as a lender with USDA Rural Development’s mortgage programs, I approach the process the same way I do with clients: clearly, calmly, and without sales pressure.

If you have questions about this step, need help preparing for a home purchase, or have a topic you’d like me to cover in a future article, feel free to reach out:

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link