Start Looking at Houses — Home Buying Step 7

How to Start Looking at Houses in the Real World

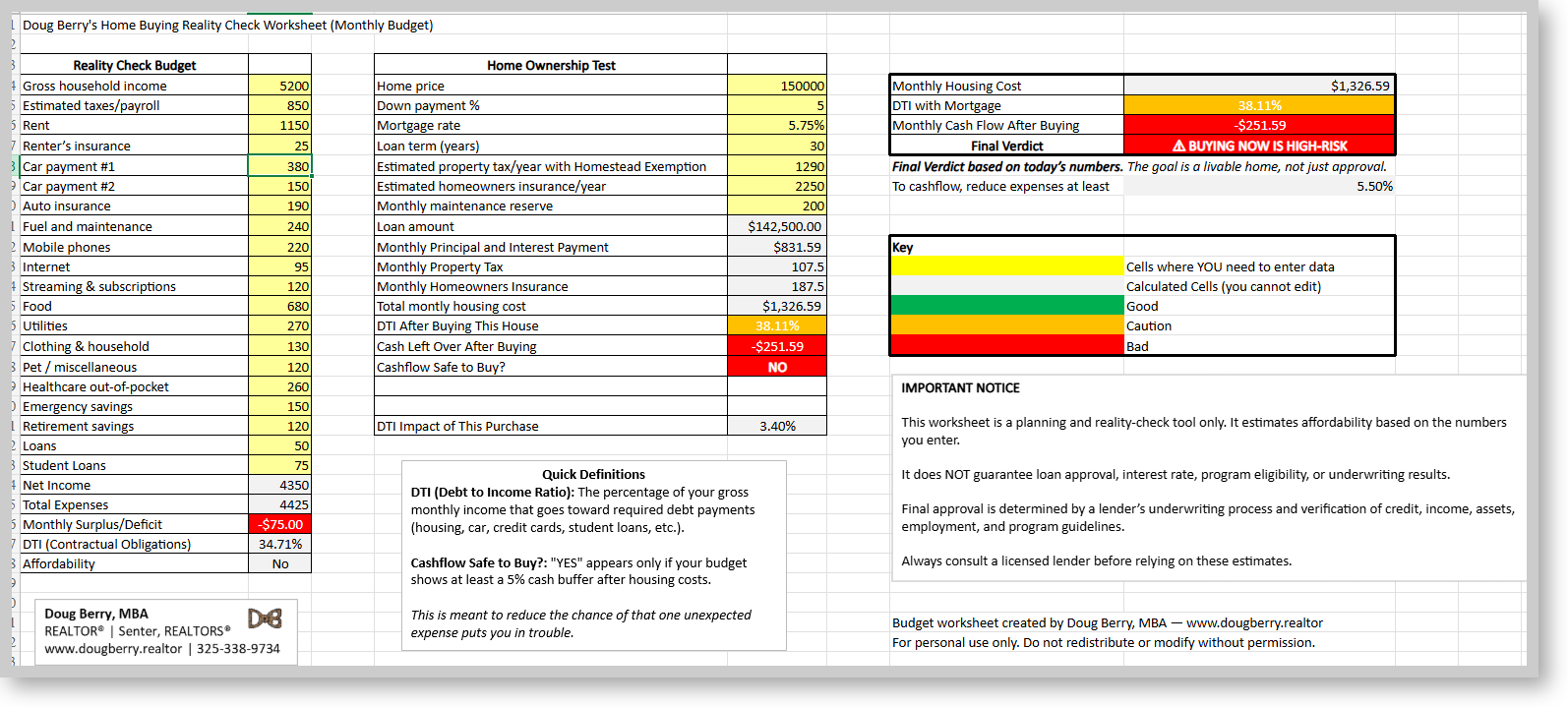

Welcome to Step 7 of my practical, experience-based Home Buying Series. If you’ve jumped in here, I strongly recommend going back to Step 1 (credit), Step 2 (budget), and Step 3 (choosing a lender). Much of what you’ll read in this step only works after those pieces are in place—especially the difference between a pre-qualification and a true pre-approval.

Most people think this is Step 1 in the buying process. That’s why so many problems appear here. By the time you start looking at houses, your loan type, budget, and underwriting picture already determine what you can—and can’t—buy.

Why You Must Be Ready Before You Start Looking at Houses

Most REALTORS® won’t start showing homes until your financing is ready. That’s not gatekeeping. It’s protecting your time, your hopes, and the hours you’d otherwise spend scrolling through houses you can’t buy.

Here’s why preparation matters:

-

Homes can move fast. If you can’t write an offer, you’re not in the market yet.

-

Your loan type quietly eliminates certain homes—even the ones that look perfect online.

-

Your budget filters the rest.

-

Your agent doesn’t want to waste your time (or theirs) showing the wrong properties.

Loan types still shape your search—even conventional loans

Historically, sellers shied away from USDA, VA, or FHA buyers because they feared repair requests triggered by the appraiser. None of this means you’re doing anything wrong as a buyer; the lending rules exist to protect you and the bank. However, here’s the part sellers don’t always realize:

Conventional loans now require repairs more often than they used to.

If an appraiser notes:

-

major roof damage

-

electrical hazards

-

plumbing failures

-

unsafe steps or missing handrails

-

significant rot or structural concerns

…a conventional lender can still halt the deal until repairs are made.

So the home that claims to “favor conventional buyers” may not actually be more flexible.

A quick note about “Cash Only” listings

If a listing says:

-

“Cash buyers only,”

-

“Investor special,”

-

“No financing available,”

-

“Seller will make no repairs,”

…it almost always means:

“This home will not pass underwriting.”

You’re not missing out on a deal as a financed buyer.

You’re avoiding a future money pit.

Know What You Want Before You Start Looking for a House

Your must-haves—beds, baths, square feet—are helpful, but deeper questions matter more when you start looking at houses:

-

New build, or older home with character?

-

How do you feel about HOAs and their rules?

-

Mature trees or a brand-new yard?

-

Historic charm or historic restrictions?

-

School districts?

-

Pool? Shop? Extra parking?

HOAs vary widely—some are barely noticeable, others are extremely strict. A change in leadership can change how they behave overnight, so know your tolerances. Your REALTOR® can guide you, but only you can choose your priorities.

Your “No-Go List” Is Just as Important

Often, the easiest way to narrow the field is to define what you absolutely will not live with:

-

Busy streets

-

Floodplains

-

Neglected neighboring properties

-

Certain school districts

-

Proximity to commercial or industrial sites

-

Neighborhoods with chronic drainage or noise issues

Negatives streamline your search faster than positives.

Of course, even with a clear no-go list, you’ll find surprises when you begin touring homes. And some of these—neglected properties in particular—may not be evident until you and your agent get to the neighborhood. REALTORS® aren’t all-knowing. They may never have seen the exact street you may want to look at, while they may know the neighborhood.

There Is No Perfect House — Not Even the One You Build

This is where many first-time buyers struggle. There is no perfect house.

People who build custom homes—who choose every detail—often discover that what looked amazing in blueprints doesn’t live well in reality. Stress can even change their feelings about the home before move-in.

A family example: my aunt and uncle bought a home in Lubbock designed by Frank Lloyd Wright. On paper, it should have been the pinnacle of homeownership. They said it was the most unlivable house they ever owned.

Architects sometimes design monuments to themselves, not homes that work for everyday life.

And this applies everywhere:

-

Beautiful kitchens with no usable counter space

-

Rooms that cost a fortune to heat or cool

-

Layouts that photograph perfectly but feel awkward in real life

You’re not looking for perfect. You’re looking for livable, functional, comfortable, and aligned with your budget.

New builds and yard-size realities

Most new-build tract homes today come with much smaller yards than older neighborhoods. Corner lots may feel larger, but they also come with more traffic and less privacy.

Everything is a tradeoff. Knowing those tradeoffs early helps manage expectations once you start looking at houses in person.

You’re Not Just Buying a House — You’re Buying the Neighborhood

This point matters more than most buyers realize. Everything outside your walls becomes part of your daily life:

-

Traffic patterns

-

Noise

-

Neighbor habits

-

Pride (or neglect) of surrounding homes

Drive the neighborhood—more than once

A quiet street at noon might become a drag strip at 9 p.m.

A peaceful area on weekends may be a school-traffic bottleneck on weekdays.

Check the neighborhood:

-

Early morning

-

Late afternoon

-

After dark

-

Weekend vs. weekday

Patterns change—and they matter.

For example, we live near a few small bars. Before COVID, one of them morphed into a motorcycle-enthusiast hangout. Not a hard-core biker bar—just a place where middle-aged guys who didn’t believe in mufflers gathered on Friday and Saturday nights. You’d never know it during the day…until you heard all the bikes fire up at 1 or 2 AM.

After COVID? No more straight pipes. The crowd disappeared, and the noise went with them.

The point is this: neighborhoods change, sometimes in very specific ways, and things that aren’t obvious during a daytime showing can become big issues—or no issue at all—once you move in.

And no, your REALTOR® probably doesn’t know what every neighborhood looks like after dark. Unless they have a big “S” on their chest.

Talk to the neighbors. Really.

You can do something your REALTOR® cannot legally do: knock on doors and ask questions.

Most neighbors will talk. People love sharing what they know—sometimes more than you expected.

A few real-world examples:

The sewer-line surprise

A neighbor once casually asked a buyer:

“Did they ever fix that sewer line problem?”

No listing sheet will give you that.

The “murderer next door” situation

Years ago, my parents toured a home where a murder had occurred. The seller disclosed the murder.

What wasn’t disclosed?

The murderer now lived in a shack next door.

A neighbor volunteered that detail.

The “creepy neighbor” test

If a neighbor makes you uncomfortable during a simple introduction, imagine living next to them. There’s no inspection for neighbor behavior.

The overly watchful neighborhood

One of my first listings was in a tight-knit, older area. Within minutes, several elderly neighbors came outside to “check” what I was doing. They watched out for each other—which can be wonderful. It also means they’ll watch you.

Listing Language: What it Really Means When You Start Looking at Houses

Even before you start looking at houses in person, listing language gives clues:

-

“Cozy” = small

-

“Needs TLC” = bring money

-

“Investor special” = major repairs (bring more money)

-

“Fixer-upper” = not financeable (bring a wheelbarrow of money)

-

“As-is” = seller will not negotiate repairs (which is not always true, after inspections)

This isn’t meant to scare you. You just need to be aware of phrases that seasoned agents recognize instantly. You don’t have to decode every adjective in a listing—but understand that real estate has its own shorthand.

And here’s a new wrinkle: with the increased use of AI to write listing descriptions, these “tell” phrases may start appearing in places where they don’t actually apply. Some descriptions are now generated by systems that don’t fully understand the nuance of a neighborhood or the condition of a property. So read listing language thoughtfully—but don’t rely on it as gospel.

Lease Timing: An Overlooked Part of Starting to Look at Houses

This topic rarely makes home-buying guides, but it matters more than people think:

If you’re approaching the end of your lease and thinking about buying, consider going month-to-month rather than signing a new 6- or 12-month lease. Sometimes being upfront—“we’re looking for houses” or “we’re about to start looking at houses”—will help your landlord understand your situation and make accommodations. Sometimes not. Not every complex offers month-to-month terms, but it’s worth asking.

When my wife and I bought our first home, we were still locked into a lease with four months remaining. Even after the apartment was re-rented, the complex made it incredibly difficult to leave without penalty.

Month-to-month would have cost more each month, but it would have saved far more overall—and given us the flexibility buyers desperately need.

Balancing Expectations When You Start Looking at Houses

You will compromise. Everyone does. The goal is understanding which compromises are acceptable:

-

Layout vs. location

-

Yard size vs. interior space

-

Newer home vs. older home

-

Condition vs. price

-

Quiet street vs. convenience

Because you’ve:

-

understood your credit

-

built a realistic budget

-

secured pre-approval

-

learned your loan type

-

fixed underwriting issues

-

chosen a REALTOR®

-

studied property-condition rules

…you’re now looking at homes you can realistically buy—not aspirational “dream homes” designed to keep you scrolling.

And a quick note:

BHGRE is rolling out AI-powered search tools that should make finding homes easier than ever. The days of crafting complex MLS filters may soon be behind us.

Why Step 7 Matters

Step 7 is where preparation turns into action. This is the moment when the houses you walk into finally connect with your budget, your loan, your comfort level, and your long-term plans.

In the next step, we’ll talk about how to narrow the field so you can compare homes objectively, avoid chasing the wrong property, and confidently identify the right one.

If you have questions about what you should be doing when you start looking at houses—or want another set of eyes on a neighborhood or listing—give me a shout. I’m always glad to help buyers make informed, comfortable decisions.

About Me — Doug Berry, MBA, REALTOR®

The Bow Tie Agent

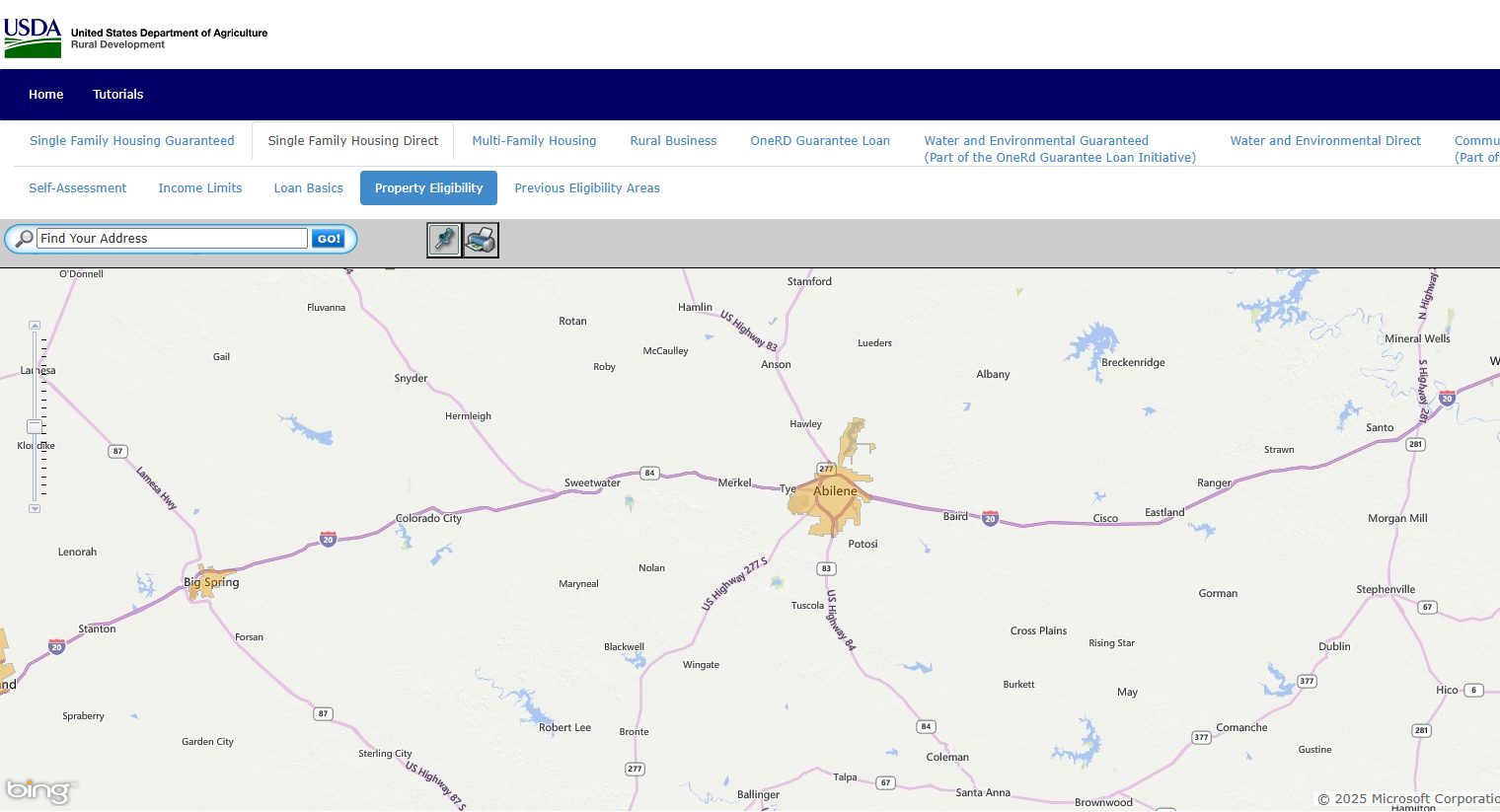

I’m a REALTOR® with Better Homes & Gardens Senter, REALTORS® who focuses on helping buyers understand the real-world side of homeownership — from lending and budgeting to navigating underwriting without surprises. With an MBA and experience as a lender with USDA Rural Development’s mortgage programs, I approach the process the same way I do with clients: clearly, calmly, and without sales pressure.

If you have questions about this step, need help preparing for a home purchase, or have a topic you’d like me to cover in a future article, feel free to reach out:

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Having derogatory items doesn’t always mean “no.” A one-time issue with a reasonable explanation may not sink your loan — but surprises will.

Having derogatory items doesn’t always mean “no.” A one-time issue with a reasonable explanation may not sink your loan — but surprises will.